You need a game plan for safeguarding your sudden wealth and making sure you’ll NEVER BE POOR AGAIN. This is it.

Sudden wealth or financial windfalls are moments in your life when the amount of money you have available is exponentially higher than usual.

So you just sold your business, sold some land for 100X what you paid for, inherited a lot of money, retired rich, or won the lottery. Now what?!

The first thing you do is buy this new AI crypto everyone’s talking about! Just kidding! DON’T do that!

By the end of this article, you’ll know the most effective ways to NEVER BE POOR AGAIN, but also to KEEP THOSE WHO WANT YOUR MONEY AWAY from your hard-earned treasure!

Here are 15 Ways To Safeguard Sudden Wealth!

Don’t worry if you don’t feel like reading, you can enjoy the video below or watch it on YouTube:

1

Don’t tell a soul!

If you want this money to have the largest possible impact on your life, you need to be focused.

This isn’t a team sport.

If fact, statistically, the more people who give their input on what you should do with the money, the lower the outcome you’ll experience.

So shut it! Sit on it. Think it through.

If the amount is life-changing, we recommend you don’t even tell your spouse until things are certain.

If your partner is more emotional than you, so be sure to prepare them beforehand. It’s super easy for their minds to immediately find things to spend it on.

Pretty soon your kids will blabber about your money at school or at the park, and now everybody knows.

Don’t tell your colleagues, family, or neighbors, and you’ll be golden.

Rich and anonymous is the way to go!

Get rid of high-interest debt immediately!

In your life, you have several elements that contribute to your poverty. Debt is by far the biggest one.

Fortunately for you, now you have the funds to buy your freedom from the banking masters.

Credit cards, payday loans, or anything with a really high-interest rate should be paid off immediately.

If you know the difference between good debt and bad debt, we want to make sure we clean up all the bad debt.

Don’t pay off your house or buy a bigger one! We’ll get to that in a second, and we promise it will make sense!

3

Max out your retirement

If you live in the US, the government incentivizes you to contribute to your retirement.

So if your employer matches your contribution, max out your 401(k). Do the same for your partner.

Roth IRA next, Then HSA.

If you’re in Europe or on the financially developed side of the world, see if your employer matches, to some degree, your contributions to your retirement plan.

Established companies offer a 50% match, up to 6% of your salary.

That’s an immediate 50% return on your investment just for looking into it.

You might not get another opportunity like this, so it pays to be smart with your money.

4

Instead of paying off your house: 75% of it should go towards rental properties (or at least the S&P500)

We know how this will sound, but you’re not going to touch the money.

Instead, you will use it to buy something that makes you money every month.

Instead of paying off your house and then living in it, paying for utilities and everything, you buy a rental property, which will pay off your mortgage every month on your behalf.

This way, you no longer have to worry about the mortgage on your place, and once it’s done paying it off for you, you still retain the rental as an asset that you pay yourself and your family every month forever.

If you don’t have enough for a place, just stick with an index fund like the S&P 500 through Vanguard.

Throw 75% of your windfall into it.

On average, it will appreciate by 10% per year. If you’re disciplined, you take less than that out and never touch the principal.

5

Instead of going on holiday: 10% to alternative investments with a proven track record

We know you want to splurge but remember: it’s all about self-control.

Keeping up with the idea that you want to spend the interest, not the principal, why not invest it in something with a good track record?

One market has already bounced back from the COVID crash, record inflation, AND supply chain turmoil.

Quicker than any other…

And if you’re really in the know, it shouldn’t be a secret.

We’re talking about Art. The ultra-wealthy have used it for centuries, and since you’re kind of rich now, you might want to do as the rich do.

Over the last 27 years, art has consistently outperformed traditional investments like stocks, real estate, and gold. That makes it a perfect investment in order to safeguard your sudden wealth.

Today’s sponsor, Masterworks, has already generated over $45 million in art sales. With the net proceeds distributed to investors like you…

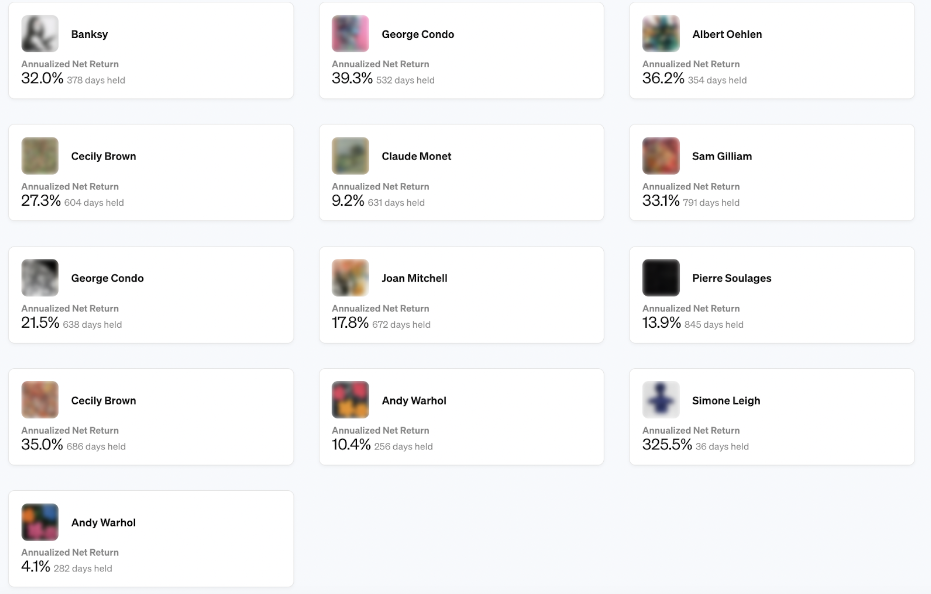

Masterworks Track Record

With Masterworks, instead of buying an entire painting, you invest in a portion of it.

- They buy the painting and then sell it for a profit.

- Those profits get split between investors.

Masterworks has gone 14 for 14, with every single exit handing back a positive return to investors like you.

Normally, there’s a waitlist to join the rich investors, but since you’re part of the Alux family, if you go to alux.com/art right now, you can skip the waitlist and make your first investment.

So instead of going on holiday on your dime, invest, cash in, use the profits to splurge, and allow Picasso or Bansky to pay for all your future holidays.

6

Get an accountant or tax advisor to make sure everything is by the book

The most common mistake people make is to get their hands on the money, immediately spend it, and never think about the financial implications.

Next thing you know, you get hit with a tax bill bigger than anything you’ve seen in your life because you forgot to pay taxes on your windfall and the IRS now wants to talk.

A decent tax consultant costs $2,000 per year, and they can make sure to save you 10 times that in the process.

So find one and allow them to see where you can save some.

You are under no obligation to pay more taxes than you are legally required to!

7

Don’t screw around – now you have something to lose

There are two main things you need to know before you start flashing your new sudden wealth around:

- Divorce is expensive, and the windfall will be split between the three of you: yourself, your spouse, and your lawyers.

Money gets you 2-3 times the attention you’ve had before. So don’t screw around and give this a little squeeze.

- If people know you have money, they’re more likely to try to get it from you.

This means actual security concerns, people trying to rob you, scam you, or legal ones: they’re going to sue, and as we’ve established at the previous point, lawyers are expensive.

You don’t need the attention. You’re happy without having to carry the financial burden you used to. Play it smart.

8

Control your spending urges

Chances are at this point you’re like a kid with chocolate in front of them on the table being asked not to touch it while the adults leave the room.

But you’ve got to have patience.

You think that getting the money is the hard part, but you’re wrong.

Here are some interesting facts:

- By the time they have retired for two years, 78% of former NFL players have gone bankrupt or are under financial stress.

- Within five years of retirement, an estimated 60% of former NBA players are broke.

Why does that happen? They can’t stop spending.

First, you pay for drinks, food, trips, and clothes and other people tell you you are cool.

Then it’s an extra car, although you don’t drive, and a better zip code—and now you can’t afford to keep all the things you’ve bought, so you need to sell—but you’re now accustomed to a certain lifestyle, and it’s messing with your head, so you end up depressed…

Control yourself. You’re an adult with access to a tool.

That sudden wealth is supposed to provide you with safety and less stress. Don’t use it as candy.

9

Consider inflation and adjust for it

Most people think keeping their sudden wealth in a bank account or under the mattress is the way to go.

Indeed, that’s the way to go. Every year, your money is worth less than the previous year.

- $100,000 today buys you a nice car.

- $100,000 bought you an apartment 10 years ago.

- 100,000 dollars 25 years ago, I bought you an entry-level house.

Realistically, you will lose 6% of your wealth every year.

The government likes to say it’s 3 to 5% at most, but it isn’t.

In times of high inflation, the purchasing power of your money, meaning how much you can buy with the same money, drops significantly.

So don’t hold on to money.

Money flees the hands of those who don’t know how to invest it!

10

You have to get smart about money

If some of the things we mentioned so far seem complicated to you, it’s because you lack a basic understanding of money.

The great news is that this is an excellent position to grow from.

Even more so, this early stage will have the largest positive impact ever on your financial growth because you have so many low-hanging fruits to solve.

Once you understand the basics, you’ll realize that the game of money and wealth is extremely fun. And when you get it right, you get rewarded with beauty, toys, and even happiness.

But it’s not like you read one book and now you know about money; it’s a lot of little things that compound over time.

If you were lucky enough to have a financial windfall, the highest return on time invested you can possibly have is a piece of content called: Principles of Wealth Building.

You can find it in the Alux app.

It costs only $34.99, but since you’re a regular reader, we’ll let you in on a little secret:

Instead of paying $35 for it, you can pay $15 for a monthly or $99 for a yearly subscription and get access to all the learning packs by Alux for a month plus our daily Alux coaching session.

If you don’t have the Alux app on your phone, we don’t even know what you’re waiting for. Download it now!

Do you see how valuable our free content is? Well, we’re saving all the really good stuff for the app.

Get the app and go through the “Principles of Wealth Building” pack to make sure you never go broke again.

11

Consider the lifetime cost of ownership for the things you buy

Rich people think differently than regular people.

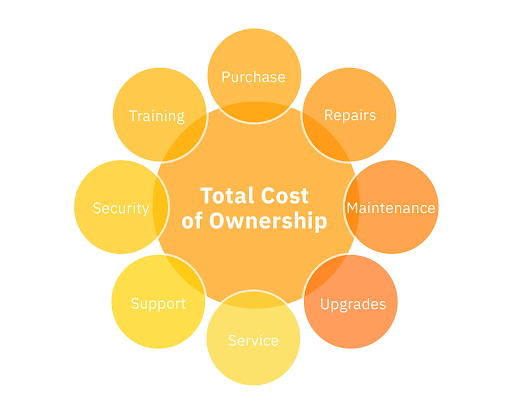

They look at something called TCO: total cost of ownership.

You think buying a new car or a new house has one cost: what you pay to get it. But that’s not the case.

Let’s say you land your sudden wealth and you buy a vacation home for $250,000. That’s the cost of the purchase.

- Maybe you need to fix the roof; that’s $10,000 in repairs.

- The kitchen needs an upgrade, so you put another $30,000 into it.

- The place has a pool, so now you have to hire someone to come clean the pool twice a month for $1000.

- Since you’re not there all the time, you need someone to check in on the place once in a while and maybe do some maintenance.

- Maybe install a couple of security cameras and sensors; that’s another $5,000 plus the ongoing subscription for those things.

- Then there’s insurance, property taxes, utility taxes, etc.

In your mind, you think the holiday house costs $250,000 because that’s what you paid for it.

But over the course of the next 20 years, it will cost you another $150,000.

So the TCO is around $400,000, with ongoing costs of $20,000 per year.

Unless you’re renting it out on Airbnb – a case in which you need to incorporate it as a business, have a property manager to deal with guests, etc – you should realize how much owning it costs you.

Total cost of Ownership

12

Do not give away parts of the principal to your family or friends

Sorry, folks, nobody gets a branch from the apple tree.

Oh, you want apples? Sure, you’ll give them some next year when the tree bears fruit, but they’re not taking a branch now.

We know it’s going to be hard looking at the pile of money and thinking that you can miraculously solve your family’s financial problems, but the truth is: they’re bad with money. That’s why they have financial problems.

Financial problems aren’t solved by money, because they’re not caused by money in the first place!

Financial problems are usually the result of bad financial choices, and giving people with a bad financial track record more money will only get them more of the same.

If you want to help, offer advice, hire them if you have to, or at most give them something of interest on your money, but never, and we mean never, touch the principal.

If you think this was harsh,

13

Do not give away a portion of it to charity

Charity doesn’t solve problems; it just creates a dependency problem on your sudden wealth!

We talked to hundreds of NGOs when we decided to build the first Alux international school in Uganda because we needed a model that we could replicate in every country in the world.

In the process, we’ve learned how the majority of them are structured and how cash is deployed.

Only 15% of the money you give to charity ends up in the hands of those who need it!

Over the past 60 years, at least $1 trillion of development-related aid has been transferred from rich countries to Africa. Not even half ended up actually being deployed. Why?

Charities use donations to pay for staff, marketing, Gallas, t-shirts, and PR events and mask all of it as operational costs.

When they get their hands on large amounts of money, there’s even corruption in terms of the companies used to do the actual building. So they invoice things that are never to be found in reality or need to be constantly renewed and maintained, as explained in the total cost of ownership.

That’s why when we decided to donate a portion of our app revenue to helping developing communities, we actually flew there, paid the invoices ourselves, and our impact has been 10 times greater than that of a large organization, despite us being a fairly small media company.

If you really want to give to charity, don’t give them money; don’t give them fish.

Give them fishing rods and show them how to fish. Even better, show them how to make their own fishing rods.

14

Move the money out of the country

If you’re fortunate enough to have sudden wealth, the kind that you want to make sure you protect for generations to come, it is always wise to have some of it outside of the country.

We’re not the conspiracy theory guys; no tin-foils here, but when Silicon Valley Bank went under, we saw a large chunk of our wealth go out of sight overnight.

Lucky for us, we are incorporated both in the US and in Europe, so for us, it was business as usual, and we were able to make payroll.

It’s the same with your money.

Go where rich people go.

Go to Puerto Rico or somewhere else with great beaches. Buy a place in Spain or Portugal.

Get yourself a golden visa so that you can live and work anywhere. If you like Asia, do it there.

Get a second passport and send some of your money abroad. You never know when it might come in handy and save the day.

The last thing on our list is:

15

Develop a vision for the rest of your life

There’s nothing more powerful than a person who knows where they’re going.

This fortune you have on your hands might be your ticket to a new life.

- What do you want that life to be?

- Who do you want to be?

- What does that person do? How does that person act? What habits do they have?

- Who are they surrounded by?

- What kind of emotions do they experience?

- Where do they live? How do they live?

We want you to take the rest of the day to think about these specific questions and come up with concrete answers.

Don’t do it for us; do it for yourself.

Now you have your sudden wealth safe and you have a vision for your life. Start enjoying it! Oh, and if you’re curious about how billionaires safeguard their wealth, go and check this article out. See you next time!