Did you ever notice that most celebrities, athletes, or one-hit wonders reach the end of their lives poor or in massive debt? That’s because of the mistakes they made once they got rich.

Getting rich is extremely hard; staying rich is almost impossible! It’s that hard because it’s that easy to make mistakes once you get rich and are not prepared for it.

Money flees the hands of those who can’t hold it!

You don’t want to make the same mistakes as most before you. So, by the end of this article, you’ll know exactly what to pay attention to. So please pay attention as we go through the list.

Here are 15 Mistakes You Make Once You Get RICH!

Don’t worry if you don’t feel like reading, you can enjoy the video below or watch it on YouTube:

1

Mistake #1 – You overestimate yourself

You’re the king of the world.

You’ve made a little bit of money, and now your ego has gone through the roof. There’s some truth to that.

Most people want money, and you excelled at a game almost everyone else fails at, so you feel good about yourself.

The biggest mistake people make when they get rich is thinking that just because you are good at optimizing some numbers on a screen, you have a relevant opinion on all sorts of issues.

Most people think they can catch lightning in a bottle over and over again, but reality is a harsh master.

A friend of the channel, Justin Khan, sold Twitch to Amazon for 1 billion dollars.

Riding on the high of his previous success, he found out the hard way that statistically, you won’t do it again.

His second business lost $75 million in the first 36 months before shutting down.

The goal is to move beyond money and maintain an open mind.

2

Mistake #2 – Losing track of your spending

Here’s a golden nugget: The more money you have, the less significant every spend is!

What that means is: Right now, you probably do not care if you buy gum at the supermarket or not.

You just put it on the conveyor belt, and whatever the price is, you know it’s covered.

The thing is, the more money you have, the more your brain automatically adjusts. Once you can afford to pay $10,000 for a bag, a $1,000 bag seems cheap.

The mistake people make once they get rich is being unaware that their brain is now wired based on the new benchmark they just set for it.

If two years ago you would’ve gone on holiday and spent only a couple thousand dollars, now that you have money, 20-30 or even 40k on a holiday isn’t something you still find outrageous.

Your spending ceiling has shot up, so anything less than the ceiling is now fair game.

The problem occurs when you don’t realize just how much money you spend on the chewing gums of your new life. Think of ordering food, restaurants, events, car rentals, clothes, gadgets, expensive water or wine, and the list goes on.

3

Mistake #3 – Spending money that’s supposed to come in soon

This is the rich people’s version of “spending money you don’t have.”

You can get away with it since it’s predictable cash flow. But here’s the deal with this common mistake people make once they get rich:

More often than not, delays may pop up and you’re left hanging. You may need to resort to short-term loans, or worse, to liquidate some of your assets to cover the bridge.

This puts you in a perpetual chase to get to 0.

Simply delay the purchase enough to see the money reach your account first. If it’s too much of a stretch, let the deal flow.

Deals and opportunities are like trains, there’s always another one coming if you just wait for it!

4

Mistake #4 – Losing your hunger

Once you make some money, you no longer feel the need to hunt because your belly is full and so is your fridge.

The problem with that is that you’re in a predatory environment where the moment you stop hunting, others will come after your food.

You will start missing opportunities, your costs will go up, you will tolerate mediocrity, and some clients will leave you.

You’ll lie to yourself, saying it’s all fine as the business keeps plateauing.

It won’t take long until you start to notice a steady decline. But it’s not enough to make you do something about it. It’s enough to keep you up at night.

Losing your hunger puts everything you’ve built at risk.

5

Mistake #5 – Being invested in only 1 asset class

It’s true that: The more you know, the less you diversify!

But not diversifying at all is a fool’s game and an easy mistake to make once you get rich.

Think about it like this. If you’re all-in on a certain industry, investment, or bet you’re making, you need to be right 100% of the time.

All it takes is one major financial event, and you get whipped out.

This is why smart investors keep a third of their portfolio in unrelated investments to the main one as hedges against whatever might happen.

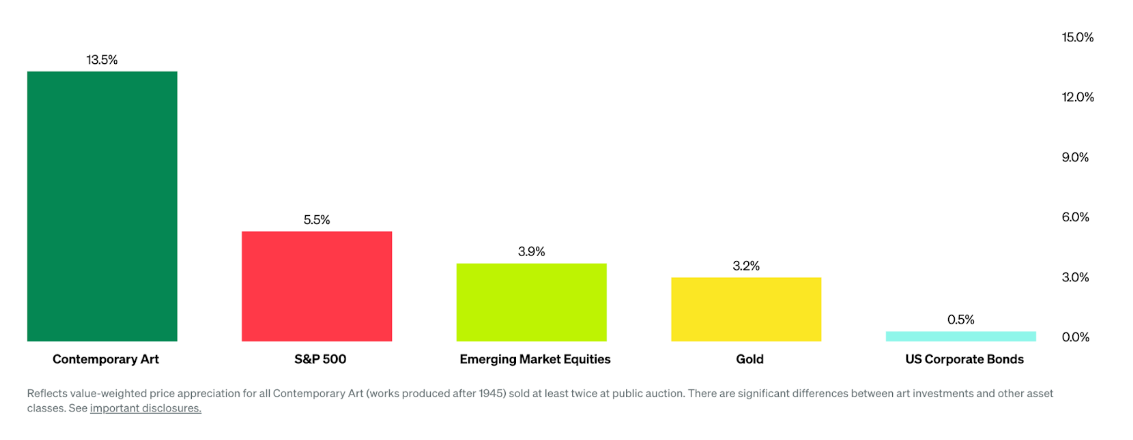

Do you think rich people buy Picassos for art?! Hilarious!

Of course not, everyone is pretending to understand art, but what they care about are the returns.

The blue-chip art market has been outperforming gold, real estate, and the stock market for the past few decades.

The last time inflation was this high, contemporary art appreciated an average of 20% per year – According to the MW Index.

The reality is that the ultra-rich kept the art thing for themselves and kept up with the high costs of entry.

However, one members-only platform is letting investors join them in this opportunity for the first time.

Our friends at Masterworks’ have an expert team that buys and sells multimillion-dollar art on behalf of a user base of over 700,000 investors.

They pick the painting and split it into shares and you buy however many shares you want. And when the painting eventually sells the profit is split between the shareholders.

Over the past two years, they’ve already delivered positive returns on 14 exits – and all ahead of the projected 3-10 year hold.

These are multi-million dollar paintings by artists like Andy Warhol, Banksy, and Cecily Brown –

Specifically selected for their performance as investments.

Masterworks is a private community with a long waiting list to get in. But since you’re reading this on our website, if you go to alux.com/art right now, you can skip the waiting list altogether.

How cool would it be to have 5-10% of your portfolio in blue chip art? It would definitely make a good conversation starter!

6

Mistake #6 – Not being paranoid enough

You might have heard the saying: “Only the paranoid survive, and although tinfoil is out of fashion, it pays off to pay attention to the way other people move towards you.

It reveals more about their intentions than what they tell you. And there are a lot of mistakes you’ll make once you get rich and have something to lose.

People are drawn to your wealth and status, and because they want what you have, they’re willing to risk more to get it.

You’re guilty of this yourself.

If you were sitting at a random table talking to some dude, he walks away, and you find out he’s a billionaire, all of a sudden you revisit the conversation to see if you can find some hidden gems.

Money multiplies offer!

This means if you used to get 2-3 romantic interests, now that you have money, that number will jump to 6-8.

7

Mistake #7 – Jets, multiple cars, multiple homes, and other comforts

With money comes comfort.

You buy it because you can afford it and you know more money is coming in soon, so no worries there.

But there is a comfort trap you’re not aware of until it’s too late.

Let’s say you fly to a faraway destination on a good airline in economy.

You’ve never flown internationally, so the quality of the food, the chair, and the blanket are an amazing experience for you.

Your happiness is a 10.

Skip a few years, and now you have money. You charter a private jet for the first time for 30,000 dollars.

You realize you didn’t have to wait to board the plane, you decide when you take off and hand-pick the people who travel with you. It’s mind-blowing.

The thing is, the private jet is now your level 10 in terms of happiness and comfort, while premium economy just fell to a 6.

So you are emotionally and internally incentivized to fill the hole of comfort based on the data you have discovered.

Here’s the mistake almost everyone makes when they get rich: Just because you can afford it doesn’t mean you should!

It’s fun to buy as many cars as you want, same with holiday homes… but there are diminishing returns to them.

Like chocolate, the first few taste the best, and then things get boring. If you keep going, you might eventually get sick.

It’s the same with these kinds of purchases. You own 10 cars and five vacation homes. All of them need maintenance.

The cars need to be parked. All of a sudden, you no longer drive the car to your destination because you’d rather not put miles on it, so you trailer it.

While you weren’t paying attention, the things you owned ended up owning you!

8

Mistake #8 – You get used to overpaying for everything

You only know this if you’ve lived it, but once you have money, you start overpaying for things all the time, just because you want to get it over with.

10 to 20% over the market price is pretty standard.

Let me give you a real-life example: The home we live in right now wasn’t for sale when we bought it. We just really liked it, contacted the owner, and asked what his number would be.

No negotiation; we paid it all in cash so we could get busy renovating.

Sure, we could’ve spent another year hoping that a similar property would show up on the market.

Once that happened, we could’ve surely spent 3 to 6 months negotiating with the owners and agents to get ourselves the absolute best possible deal. But in the process, we would’ve wasted a year and a half for a 20% premium.

In our eyes, the speed was worth it.

We no longer book plane tickets 4 to 6 months in advance. We’re ok with paying whatever the going rate is a couple of days before we leave because it gives us more flexibility.

Flying into NYC or Monaco, we no longer take a cab. Instead, we book a helicopter for 2x the price of a taxi, but we get to our destination in 5 minutes.

In this case, additional money buys you convenience.

The mistake is when this behavior transitions to other parts of your life and other people take advantage of you.

9

Throwing money at every “opportunity” coming your way

Here’s the deal with this mistake almost every young entrepreneur makes when they get rich:

With great money come many opportunities! Or whatever Uncle Ben was trying to teach Peter…

When we began angel investing through our venture capital fund, we were surprised by just how many great investment opportunities were around us.

Super talented founders building incredible companies.

Because these companies were in their earliest stages, our usual ticket was between 20-50,000 dollars.

In the first year, we did 10 deals since it’s almost a numbers game.

One of our older mentors shifted our perspective on this: 20,000 dollars isn’t enough to make or break us, so instead of doing these smaller deals, take the money and travel.

With $20,000, you can have a really memorable trip with your spouse, and those memories will be there with you forever.

Even if we hit big – which was statistically improbable – and the company had 20Xd in valuation, our 20K would’ve turned into 400,000 dollars, which is a lot of money but not reality shifting for us.

Not to mention that once you have money, all your relatives and childhood friends will show up at your doorstep with great business ideas just waiting for you to part with your cash.

10

Not continuing to level up

With every new stage you enter in life, you’ll encounter different kinds of problems and challenges.

You think that just because you became a millionaire, you have enough know-how and wisdom to navigate the rest of your life, but you are sadly mistaken.

What got you from 0 to 1 million is not enough to get you from 1 to 100 million.

The relationships you have now are different than the ones you had when you were broke. Even if you wish it weren’t true, it is.

All the elements in your life gravitate differently toward you.

In the same way, you needed specialized skills to be able to make the leap to wealth.

You will need a different set of skills to:

- stay healthy in a high-stress environment

- be a great parent

- not neglect your partner

- keep the spark alive

- be able to build real teams that can help you grow the business.

All of this can be learned, and rich people spend hundreds of thousands of dollars per year just to give themselves this unfair advantage of having access to the best roadmaps available.

We wanted to completely change the game and give everyone access to the same kind of high-level insights that only the rich could afford.

We pay international experts a ton of money for their advice and expertise, distill it, and put it all in the Alux app—the only app specifically designed to hold your hand as you make real progress in life.

We’re closing in on the first million dollars spent on insights and content for the app alone, and you’re getting access to it for only $99 per year.

Literally, you get a million dollars worth of value for less than it costs you to eat out.

Download the app right now and allow us to accelerate your progress in life!

11

Failing to monitor and adjust the course of your investments

They say that the best investments in life are the ones you set aside and forget about—if only there were such a thing.

We’ve done plenty of articles on why passive income is a myth, and you know that even the most passive of investments still require you to pay taxes – keep up with the management company to make sure they aren’t working the books – or that your assets are being taken care of.

The difference lies in the frequency of inputs.

With real estate, you only have to get involved when you buy, refurbish, and rent.

Once the tenant leaves, you repeat the maintenance cycle. Let’s say you have to do it once every few years. With handpicked stocks, that frequency bumps up to almost daily monitoring.

Getting out of an investment, taking profits, and moving into another. All matter, like everything else in the universe, has a tendency to decay.

Your investments follow that rule. The moment you take your eyes off of it, they start to tremble.

It might not be apparent immediately, but by the time you realize what’s happening, it might be too late.

Our advice: diversify selectively and make sure to rebalance your portfolios.

More often than not, you’ll find you’d be better off exiting the position while it’s going up than waiting for it and seeing what happens.

Nobody went broke taking profits!

12

Not protecting your reputation

You might think that money buys reputation. It’s actually the other way around.

People want to do business with people who have a pristine professional reputation.

Do not associate with people who have dirty reputations, for their dirt will rub off on you, and people will put all of you in the same bucket.

13

Playing catch up with your even richer friends

The most common and valuable advice for poor people is: Stop acting like you’re rich. It’s actually making you poor!

It turns out this advice also applies to rich people who are pretending to be even richer than they are just to keep up with their version of keeping up with the Joneses.

Shame is in part responsible for many making this mistake once they get rich. There’s nothing to be ashamed of if something is too rich for your blood.

It’s ok to say no to spending 15,000 per night for a week at the Four Seasons Bali Resort when you and your entire family can live like kings for a month for the cost of just two nights there.

It’s always better to be friends with someone who has a yacht than to be the person who owns the yacht!

Just because they have one doesn’t mean you should either.

14

Making decisions based on other people’s decisions without thinking for yourself

We made this mistake once we got rich too and it led us to lose over 1 million dollars in a single year.

When you make money, you find yourself surrounded by other rich people who you assume are all smarter than you are.

Most of them have hundreds of millions of dollars on their hands and access to some of the best market analysts, so it makes sense for you to think you can leverage their infrastructure and insights for profit.

FTX is a great example of where we bought into the premise that this is a well-run company, based on the fact that Paradigm and Sequoia collectively put in 900 million dollars into the business.

These are smart people, and even they got it wrong.

Just because someone is doing something doesn’t mean you should!

Stick to what you know, or even better, stick to avenues where you can alter the outcome!

15

Inability to relate to people struggling with the basics

It’s easy to lose your grip on reality when you haven’t had to struggle for a while.

From where you’re sitting, the way to get out of the maze might seem obvious, but you’re blinded by the fact that you’re looking at it from above.

To the person stuck in the maze running around like crazy, the perspective is quite different.

This will make you seem out of touch or even be perceived as arrogant. This a mistake you see many people making once they get rich.

You will be oblivious to what other people are going through, which in turn will make you a poor manager of the human resources you have under you.

Once you lose a grip on their reality, you will lose that personal touch, and it’s all downhill from there.

Root yourself in reality, visit your parents, talk to your grandparents if they are still alive, or revisit your birthplace.

It will help you live with gratitude and not take anything you have for granted. That’s how you win!

Bonus

Big goals take time

The more you mature mentally, the more you realize just how time-consuming some goals are.

We thought going from 1 million to 10 million to 100 million to eventually a billion would be something exponential, but it’s not.

It takes building more and more infrastructure around you. It requires you to fire yourself from what you’re doing in order to open up time to learn and build the stepping stones for the next level.

A few months ago, we had the privilege of talking to one of the top investment bankers in New York. We asked what his advice would be to take Alux from our current mid-8-figure valuation to 9 and eventually 10 figures.

This is what he told us: Bring someone in to run the $50 million business so you can build the billion-dollar company without being distracted by this one!

The shift in perspective was immediate. Especially since it doubled down on something Sam Altman, the founder of openAI, taught us while he was speaking at Ycombinator:

All successful founders are able to transition from building a product to building a business. You build a business by building teams. If your team stinks, you have a job, not a business.

Time will pass either way, and your time is incredibly valuable.

Shift from products to teams, then allow your teams to build the product for you. This will free you up to take down those metaphorical mammoths moving forward.

By the way, we think this is one of the most valuable bonuses we’ve ever put in an article, and in the right years, this will be life-changing.

Now you should have everything you need to avoid these mistakes once you get rich. See you next time!