There’s a lot of money to make in weird places and through uncommon investments.

And most people don’t realize just how high the returns are if you just look outside of the savings account and real estate.

By the end of this article, you’ll have a full list of options that are outperforming traditional investments.

Here are 15 uncommon investments that actually make A LOT of money:

Don’t worry if you don’t feel like reading, you can enjoy the video below or watch it on YouTube:

1

ETFs targeting weird niches

These are as an uncommon investment as it gets but somehow they make money.

I’m not sure how many of you remember the Obesity ETF from a couple of years ago.

It’s been liquidated since then, but basically, it was a bundle of all the companies that would profit from the US population getting fat.

Ironically, the ticker was SLIM, and it did really well.

It turns out there are a bunch of these ETFs designed to make you money based on niche interests.

Here are a couple of examples: The UFO ETF—it’s actually called the Procure Space ETF—basically invests in everything related to space exploration and monetizing space in general.

If you remember the recent GameStop fiasco, well, there’s a MEME ETF now called: Roundhill MEME ETF (MEME) that basically bundles together all the companies the folks on WallstreetBets are gambling on.

AdvisorShares Vice ETF—ticker VICE—bundles all the companies that are bad for the company but good for your wallet: Think tobacco, alcohol, gambling, and maybe some chocolate.

Lastly, before we move on to the next one, if you’re a boomer, you probably know who Jim Cramer is. He’s an old guy on TV, picking stocks and giving investment advice.

He’s been publicly wrong so many times in his predictions that the internet almost turned him into a meme, and now there’s actually something called the: Inverse Cramer ETF (SJIM),

where basically, every time Cramer recommends the sale of a stock, you buy more of it and reverse.

2

Self-Whatever

Automation is a bigger deal than you think, and before you picture robots walking down the street, think more in the realm of vending machines.

Self-service car washes are a great example.

They’re a fraction of the cost of those big automated car washes and require little upkeep.

They only cost 25-35,000 dollars in equipment – without taking into account land ownership or the lease payment.

The average monthly revenue per bay is $1,489: Break-even on those is under 3 years, considering all costs.

Self-storage is another big one.

You just need space; just pay for security and the space.

Laundromats, RV rentals, and even Self-Service Printing – be it in a mall kiosk or online: basically, upload your photos to a cloud drive, pay, and they get shipped to you.

There’s a lot of value in having pictures in physical form.

Self-service is slowly taking over because the left has insisted on raising the minimum wage for unskilled workers.

Starbucks has begun installing self-service kiosks in Chinese supermarkets, where you shop around for groceries, and when you’re ready to go out, your coffee is waiting for you.

3

Buy land 30 minutes away and wait 20 years

People try to make real estate investing complicated, but if you have some money and time, it can be the simplest way to get rich.

Basically, every city has a main road, a city center, if you will.

From the city center, drive straight for 30 minutes, then stop.

Buy the land around you and wait 20 years.

That’s it. It’s just a matter of time before the city expands, and eventually, businesses will be looking for land.

That’s when you sell at a 10 or 20x markup of what you paid for.

Right now, agricultural land is dirt cheap. If you’ve got time on your hands and it seems like the city is expanding, buy the nearest agricultural land available to the city and wait it out

4

Buying other people’s debt or tax liens

You know when people borrow money for something and set their car or house as collateral?

That debt is traded on secondary markets, meaning financial institutions sell the debt from one to another.

This is one of the more uncommon and underestimated investments that actually makes money.

Banks and other institutions might not want to waste time and resources dealing with hard-to-collect debtors, so they sell the debt at a discount because some money is better than none.

You can buy the debt someone has and be the one who collects the payments and the interest on that debt.

You can also buy the debt, and if they fail to make their payments, you can legally collect their collateral.

In some cases, you can even buy your own debt for 50 cents on the dollar if they fail to collect for a long time.

5

Executive Coaches

Coaching works. Great coaching works extremely well.

It provides clarity and accelerates progress.

A good executive coach is a mentor who can not only save you millions of dollars in mistakes but can also help you get to where you’re going in half the time. This is why the best executive coaches cost over $100,000 per year + a commission on the value added.

This is not like therapy, where they just ask questions, but more like a second opinion with a lot of expertise behind it.

Your business life changes once you get a mentor who keeps you focused and clears a path forward.

We know it’s expensive, but the most valuable things in life are.

Well, it was expensive until we came around and launched the Alux app.

We pay the coaches on your behalf, and you get the same level of expertise as the top CEOs in Silicon Valley.

Download the app right now and get over 1 million dollars worth of value for only $99. The app pays for itself before the end of the first month.

6

Parking Spots

You weren’t expecting this one, admit it. Even though it’s an investment more uncommon than others, parking is an in-demand commodity that actually makes money.

There’s little differentiation; technology has caught up to the point where a parking lot can be fully self-served and it just prints cash.

As long as there’s a reason for people to drive up to your location, you’re winning.

Parking lots are out-cash-flowing commercial property with a tenth of the costs.

Instead of running a business, you just have space and an electric barrier that prints tickets and charges people. There’s even a surge mechanism for the cost of parking during peak events.

We love parking lots as a business not only because it’s cash flow positive with little outside investment but also because the location is the primary value add; every year the value of the land goes up.

10-20 years of profits, and then you sell big to a commercial developer.

7

Trading natural gas and energy

Energy traders earn a ballpark of 200,000 dollars per year on the low end and around half a million per year if they’re doing a good enough job to qualify for bonuses. and that’s salary, meaning this is how much companies pay their employees to keep trading.

There are many ways to trade natural gas and energy.

You can do it digitally like you would be trading stocks, which is basically the trade of a financial product.

You can buy – and sell futures; if you’re more advanced, you can actually buy the physical product, store it, and resell it for profit.

There’s the logistics behind the transport or processing of crude oil from production to the end consumer.

There are companies that own the pipelines that transport the oil and gas underneath the earth from point A to point B.

You pay those companies a lease to be allowed to use their network of pipes. It’s by far one of the most profitable investments to make money and it’s highly uncommon.

8

Early-stage startup investing or straight-up buying Digital Businesses

In the US, if you’re an accredited investor, meaning you have a net worth of over 1 million dollars or a take-home salary higher than 200,000 dollars per year, you can invest in early-stage companies.

Writing a 25-50,000 dollar investment in a small company that has a lot of potential could prove to be one of the best investments of your life.

That’s what venture capital firms do.

We find interesting companies, make 10-20 investments, and then use the networks you’ve garnered to offer those companies a chance of hitting it big.

4 out of the 10 usually fail completely.

3 are breakeven-ish, 2 are profitable, and if you’re really good, one of them knocks it out of the park and pays for everything else.

There are plenty of platforms that allow you to become an angel investor: Angelist in the US was founded by Naval Ravikant; Seedblink in Europe was founded by Radu Georgescu.

If you don’t like the idea of being a portfolio investor, you can simply purchase a viable business.

A friend of Alux and serial entrepreneur Andrew Gazdecki is the founder of acquire.com, a platform where people list their businesses for sale.

From $10,000 all the way to tens of millions.

9

Music catalogs

You might not realize it, but music is an incredible asset class. It’s such an uncommon investment that most people don’t even know you can make money off it.

A great song will earn royalties for years on years. But since you’re not an artist, how can you own music?

Most people think artists are the owners of their own songs, but that’s not true.

It’s the label that owns the masters most of the time—basically, the rights to a song—and the artist, if they’re lucky or had smart lawyers, only gets a fraction of the money coming in.

This is why music labels are almost always richer than artists, and there’s usually no way for you, an outsider or a small investor, to get your hands on anything of value.

That’s changing with technology.

A bunch of these platforms popped up, allowing artists to upload their masters for their songs and sell fractional ownership of the song.

When it gets played on the radio, YouTube, or in a mall, the song earns the master money. That money gets distributed to investors.

Songvest, Royal.io, Sonomo, MasterExchange, and GlobalRockstar are just a couple.

The industry isn’t yet dominated by one platform, but it’s just a matter of time until one or two separate themselves from the crowd.

Being a fractional owner in the success of an artist, a football club, a creator, or a streamer are just some of the things we expect to become more frequent in the years to come.

10

Art

The paintings you don’t understand on the walls of really rich people are actually phenomenal asset classes.

You might not realize it, but good art is outperforming most traditional investments while serving as a diversification mechanism for the rich.

Why? Because it’s uncorrelated. If there’s an energy crisis, art keeps going up.

For years, art has been recession-proof and a way to store value over time. A very uncommon investment, but one that makes real money.

And not until recently, the market was closed off to retail investors. It was expensive and simply just not accessible to the masses. But that’s changed.

Masterworks has changed the rules of the game by allowing retail investors to get their hands on a share of high-end art. Masterworks buys the piece and sells it for a profit, distributing the profit to investors like yourself.

So far they’re at 100% profit rate with all their sales. It’s definitely worth checking out. And because you’re reading this in our website, you get the skip the very long waiting list. Head here to start investing.

11

Supercar collecting

Actually, the activity of collecting ultra-luxury items has been quite profitable as a whole.

From luxury watches to Hermes bags to pens to whatever

But out of all of them, supercars take the win.

The average car loses its value gradually and consistently year over year, making it a liability.

Supercars, on the other hand, have a collector’s appeal. They’re made in a limited run.

They’re really expensive and as close to works of mechanical art as they get.

With the way the industry is transitioning to electric cars, the current petrol-fueled supercars will feel like the Oldsmobile of the past, and their value will keep going up.

Porsches are a great entry point.

The value holds over time, with many old Porsche models, like the 911 Targa, selling for over 1 million dollars today.

Way higher than they did when they were brand new, even adjusted for inflation.

Although Lamborghini sells more cars per year, Ferraris has proven to be a more profitable long-term investment. Then you get into the Bugatti, the Paganis, and other limited edition pieces.

12

Whiskey and Fine Wine

Fractional investing is here to stay, and we believe most industries that rely on the appreciation of an asset class will eventually be democratized.

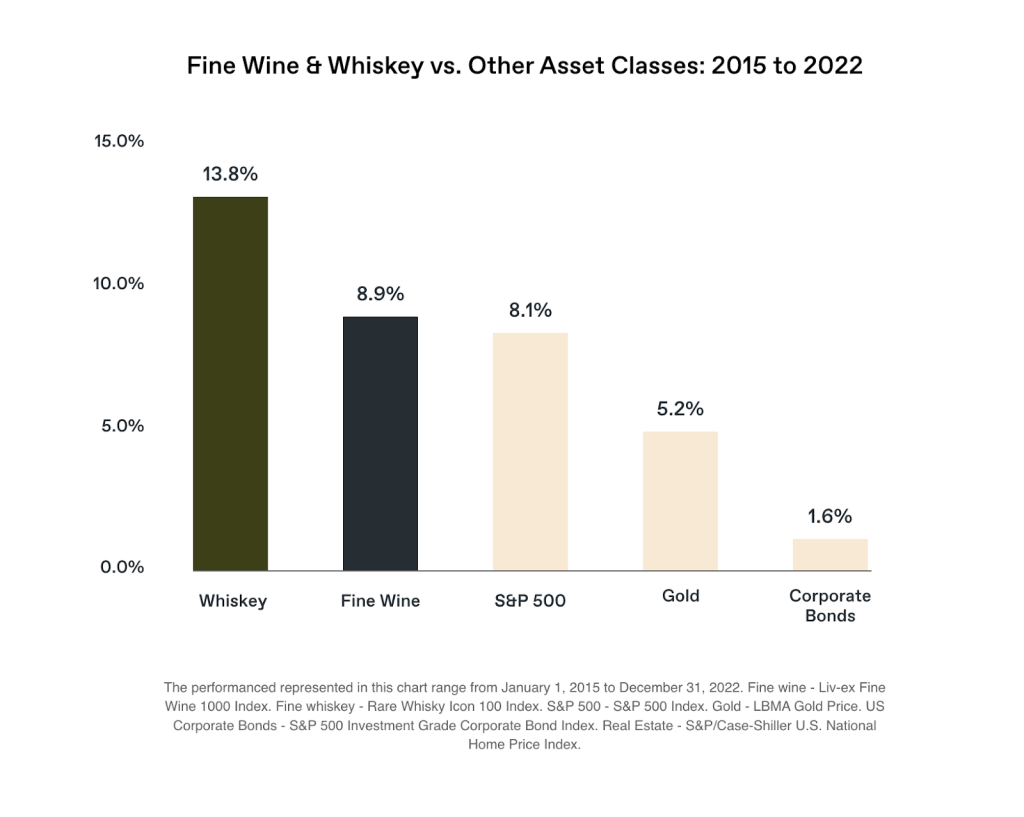

Like blue-chip art, whiskey, and wine will see an uptick in investments because most people have no idea that whiskey’s performance is almost 3X that of gold and that wine has been constantly ahead of the S&P 500.

Fine Wine and Whiskey vs Other Assets – 2015 to 2022

Vinovest, Whiskeyinvestdirect there are plenty of platforms available now that allow retail investors such as yourself to participate in these markets without the need to physically hold the goods.

They buy, hold, and resell on your behalf; you just finance the deal.

With an above 10% return, it’s an uncommon investment well worth the money. Who knew there was this much cash in alcohol?

13

Rare coins and strange collectibles

Stamps and rare coins are something our generation probably doesn’t care about.

We don’t even know where you buy stamps these days. Do they sell online?

But there’s a market for collectors. And judging by the numbers, we’d say it’s a very profitable investment even though it’s highly uncommon.

The stranger and more niche it is, the more obsessed people are with it.

Going from broad collections like comic books and Magic the Gathering cards to sneakers to unopened old Coke bottles

We’re not kidding; these babies sell for $5,000 a POP. We know that was a dad joke, but hit the like button if it makes you giggle.

Old Pez dispensers from the 70s are selling for over 2 grand, and people buy and sell them in bulk.

There are forums online of people buying trading cards by the pallet and putting them in storage untouched to resell in 3-5 years for 2-3x the money they spent.

Honestly, we gotta be real with you. Unless your world revolves around a niche community, we would advise against going into something like this because of the limited demand and how prone to hype these can be.

NFTs always gave us beanie-baby vibes, and now both markets are worthless.

14

Old patents and copyrights

Did you know you can buy old copyrights, books, logos, or anything else commercially creative and relaunch it as your own?

Here’s a crazy story for you.

The fidget spinner was invented in 1997 by a woman named Catherine Hettinger because she wanted to be able to play with her daughter, who struggled with autism.

She patented the design and even pitched it to Hasbro, but they passed.

In 2005, the patent expired because Hettinger couldn’t afford to renew it since it costs $400 per year.

15 years later, people found it, and it became the biggest toy on the planet.

Everybody’s selling it, and Hettinger didn’t get a dime and is actually struggling financially. By the way, even Hasbro is selling fidget spinners since they are no longer protected.

If you’ve been an Aluxer for a while, you know about Dale Carnegie’s book on how to win friends and influence people.

Since the book was originally published in 1936, its contents are actually in the public domain, despite the family’s efforts to copyright variations of the book.

This is why you see different book publishers print their own versions with a variety of covers; they’re just using public domain IP to cash in.

And there are a bunch of these stories around. Maybe we’ll do one in the future.

But let’s get back to our uncommon investments that have incredible returns.

15

Unique Holiday Rentals

What if I told you there’s a Potato AirBnb in Idaho that rents for $1000 per 3 night, earning its owner around 100,000 dollars per year?

Or a boot home in New Zealand doing similar numbers?

People pay for the novelty factor.

- Cave homes rent for 1500 dollars a night.

- Literal castles for $2000 a night.

- There’s an OMG tab where you can actually sort based on crazy, weird homes.

Since our generation is so hungry for experiences, they don’t mind paying a little bit extra to have a great story to tell once they get back home.

Bonus

The gold is in what you know that others don’t

The more we looked at the list we explored today, the more we realized that each one of them requires a slight information edge.

In order to make money in any of these 15, you need to have an unfair informational advantage.

You need to know something other people don’t. That’s where the profit is.

So the most practical piece of advice you can take away from this is to look at your own life and identify the thing that you spend time learning about because it’s fun.

There’s definitely something you do for fun that other people would think of as work.

That’s the gold mine.

Once you identify it, figure out where the financial arbitrage is, and go after the money. Nobody gets into any of these businesses because they have a calling.

They all do it for the money in the beginning; you get good at it in time, make small changes,, and then turn it into your calling.

Not the other way around. This is why finding your passion is bullsh*t.

Because it assumes it’s something you don’t already have and that you need to go and find somewhere else, and until you do, you will never be complete.

The most valuable advice you’ll ever get is:

DO IT FOR THE MONEY in the early days and figure out how to navigate from there.

It’s easier to move faster when you’ve got some gas in the tank.

This concludes our list of the most uncommon investments that actually make A LOT of money. We hope some light bulbs are shining right now after reading this one. If it does, put it to good use. Until next time!